Payment Transactions Schemas

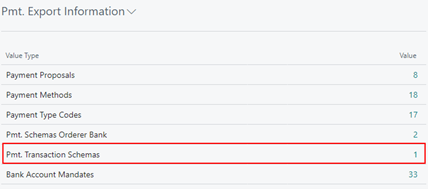

Within the OPplus Role Center, you will find, among others, the list of Pmt. Export Information. Below you can branch to the existing payment schemes transactions:

Alternatively, also via the OPplus Role Center > Actions > Import/Export setup > Pmt. Export

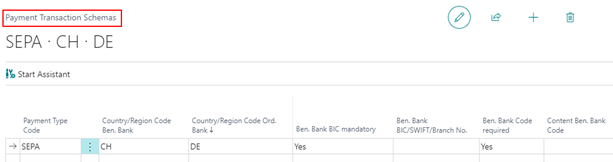

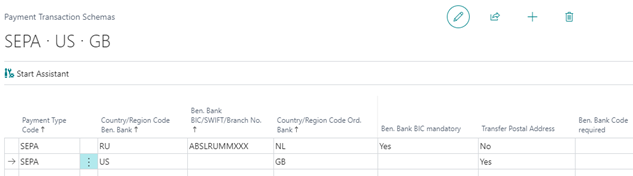

Via a payment transactions schema, the fields "Transfer Postal Address" and "Ben. Bank BIC mandatory", among others, can be maintained per bank/payment type and (target) country code, if required.

In the following example, two specific setups have been established for payment transactions schemas:

- a SEPA payment from the Netherlands to Russia.

- a SEPA Payment from the United Kingdom to the United States of America.

Warning

All settings must be made with the utmost care and saved after the test runs have been completed. A single incorrect field setting can already result in a created payment file or an individual transaction being rejected, whereby "incorrect" and "correct" at this point depend on the credit institutions concerned and the countries involved. It is also recommended that test files are reconciled with the bank before the live operation of these settings is started.

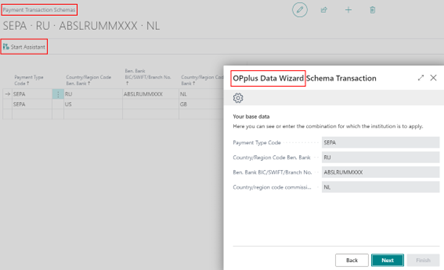

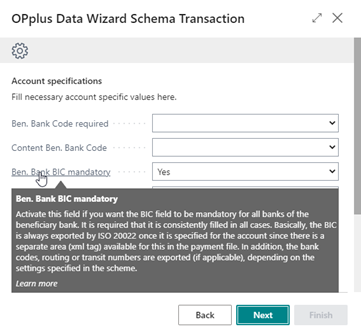

Also, when setting up the payment transactions schemas, you can choose from any combination of payment types, Country/Region Code Ben. Bank, Ben. Bank BIC/SWIFT/Branch No. and Country/Region Code Ord. Bank, a setup assistant is available to assist you in creating a suitable schema.

All existing setup fields are provided with explanatory tooltips as part of the payment scheme transactions in the application, so we will not describe the individual fields further here.

Detailed tooltips in the OPplus setup assistant facilitate the setup to be made for a payment transactions schema:

ISO Payment

The standard format UNIversal Financial Industry (UNIFI) Message Scheme ISO 20022, here abbreviated to ISO Payment, is increasingly being introduced in global payment traffic. The already established SEPA format is also based on ISO 20022 UNIFI, with the restriction to EUR payments, Charge Bearer SLEV (= ServiceLevel), and the exclusive use of IBAN and BIC in the SEPA messages used. In ISO Payment these restrictions do not exist. Depending on the circumstances in the countries and currencies involved in the payment transaction, also:

- Conventional account numbers (BBAN: Basic Bank Account No.) and bank codes

- Routing no. or transit no. (these also in connection with standardized five-digit codes of clearing systems)

- Exact address data of all parties involved (orderer party, orderer bank, beneficiary bank, payee)

become necessary.

Also, accompanying information, such as

- Fee settings (unlike SEPA transactions, ISO Payment transactions are not free of fees).

- Sender ID for identification of the client - depending on the requirement, both with company name and without

- Urgent orders e.g. Service Level URGP -> Urgent Payment - in the file either at header or item level as required.

- Additional branch no. of the bank branch

- Amount formatting without decimal places (e.g. for Japanese Yen) etc.

lead to the fact that a large number of further setup possibilities in OPplus have been realized via the payment transactions schemas in order to map all requirements known so far.

Note

Due to the complexity of the payment format/payment type ISO Payment, we have created detailed, separate documentation where you can find more information about the integration of the payment format ISO Payment in OPplus. This document is available for download on our homepage and in the partner portal.