Importing Pmt. using REMADV and PI

intro

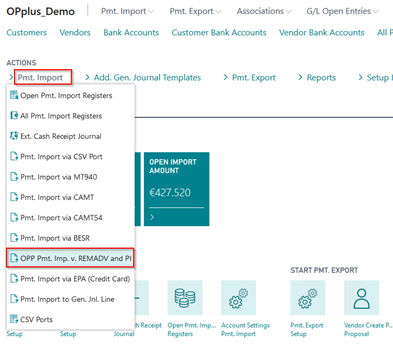

If you receive payment advices as REMADV file, you can import them here:

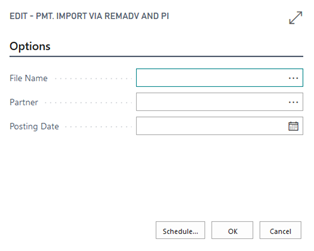

Subsequently, the following window appears:

| Option | Description |

|---|---|

| Filename | This field is used to enter the complete path and file name of the file you want to process. You can select an existing file by clicking the AssistButton. |

| Posting Date | This field is used to enter the date on which you want to post the general ledger entries. |

| Partner | This field can be used in the Accounting Rules in catchword 2. In case you have entered a partner upon importing REMADV, this partner will be entered in the “Catchword 2” field giving you the possibility to have per partner equal deduction types with different accounting rules. |

Upon importing REMADV the accounting rules are used for accounting the deduction types. The located deduction types will be entered in the “Catchword” field. In case you have entered a partner upon importing REMADV, this partner will be entered in the “Catchword 2” field giving you the possibility to have per partner equal deduction types with different accounting rules. The located document number in REMADV for document search might be affected via the accounting hint texts.

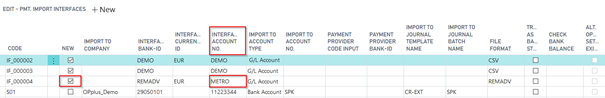

According to the OPplus logic, they are imported via pmt. import interfaces and pmt. import registers. Here, the system tries to perform accounting and automatic application. Any lines which are not automatically applicate by the system need to be processed by the user. Import during imports via REMADV:

The value specified in the “Partner” field will be entered in the Pmt. Import Interface in the “Interface Account No.” field. If no partner is found, a new pmt. interface will be created.

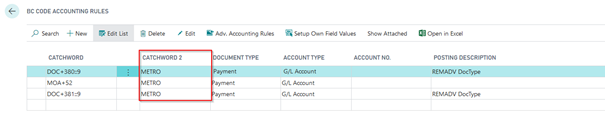

Furthermore, records are created in the BC Accounting Rules during the import, which include a search term as catchword for account assignment (for documents/adjustments/ etc.) and ‘partner’ as catchword 2.

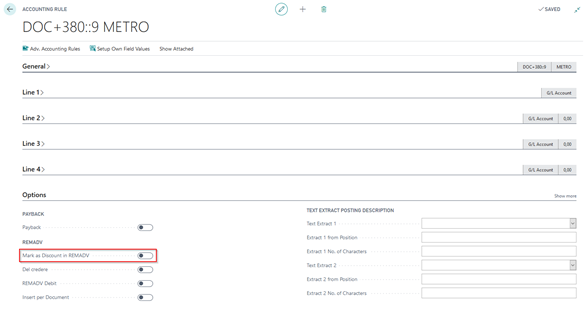

In this example, the 2 BC codes are created referring to documents (DOC*) and 5 BC codes referring to adjustments (AJT*). Now the user can determine which accounts to use for posting the documents/adjustments.

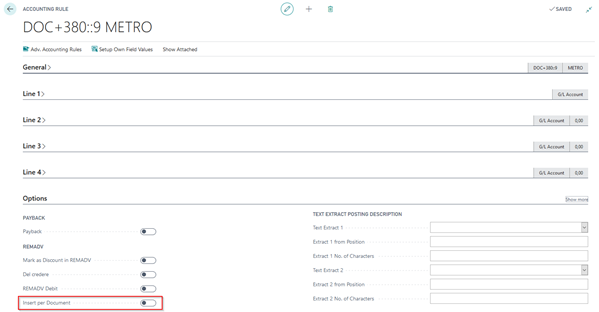

In the BC Code Accounting Rules, you have the option to use the “Insert per Document” field.

If you activate this field, the system will insert an additional line for each line in the journal. If you leave this field deactivated, the system will insert a line including the total sum.

If the created BC code refers to a pmt. discount amount, you can use the “Mark as Discount in REMADV” field. If this field is activated, the pmt. discount (if an associated document is found) will be taken, posted and copied into the journal. If no documents are found, the system will show the total sum for the open, unassigned pmt. discount amount in the end of the journal.

The same functionality applies for “Del credere“.